fanduel winnings taxed|How to Pay Taxes on Gambling Winnings and Losses : Manila FanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced . Tingnan ang higit pa 7Bit Casino offers players a unique generous welcome bonus you may not find in another casino. Unlike other casinos offering two or three Matched deposit welcome bonuses, 7Bit Casino offers four matching deposit bonuses.. The first deposit is worth up to 1.5 BTC, while the second and third are worth 1.25 BTC each.

PH0 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH1 · Taxes

PH2 · Tax Considerations for Fantasy Sports Fans

PH3 · TVG

PH4 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH5 · Sports Betting Taxes: How They Work, What's Taxable

PH6 · Sports Betting Taxes: How They Work, What's

PH7 · How to Pay Taxes on Gambling Winnings and Losses

PH8 · How Much Taxes Do You Pay On Sports Betting?

PH9 · Frequently Asked Questions

PH10 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & Losses

PH11 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH12 · Effective Strategies to Handle Tax Withholding on FanDuel Winnings

PH13 · Effective Strategies to Handle Tax Withholding on FanDuel

PH14 · Do I Have To Report FanDuel Winnings On Taxes?

This website is a collection of the hottest Pinoy gay sex stories submitted by our readers, gathered from other sources on the web, and written by our in-house authors. If you are an author who owns the rights to any of the content on this site and do not wish them to be published here, .

fanduel winnings taxed*******We’re legally required to withhold federal taxes from sports wagering winning transactions as well as other qualifying casino game winning transactions when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) are at . Tingnan ang higit paThe Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, . Tingnan ang higit paA Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements depend on the type of gambling . Tingnan ang higit pafanduel winnings taxedFanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing authorities based on the IRS Form 1099 . Tingnan ang higit pa

FanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced . Tingnan ang higit pa

For professional gamers, Fanduel winnings are considered regular income. This means they’ll be subject to the same tax rates as any other earnings – ranging from .

Yes, FanDuel may periodically deduct taxes from your betting account. For instance, if you win $5,000 or more and the winnings are at least 300 times the wager, .fanduel winnings taxed How to Pay Taxes on Gambling Winnings and LossesFantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on .How to Pay Taxes on Gambling Winnings and LossesTVG - Taxes, W2-Gs & Year End Reports. Due to updated regulations from the IRS regarding the reporting of wager winnings, there are only two specific circumstances in . If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting taxes, .

If you have gambling winnings, it's worthwhile to understand the tax considerations in the state where you live and where you gambled.

When you win, your winnings are taxable income, subject to its own tax rules. TABLE OF CONTENTS. You are required to .

FanDuel, as a responsible payor, adheres to IRS guidelines and withholds federal tax from certain winnings. This includes winnings over $600 in a year, from off .

It depends on how much you win. By law, you must report any sports betting winnings as income on your federal tax return. But that gambling-related income is only .FanDuel Winnings and Taxes. If you win money on FanDuel, that money is considered taxable income. FanDuel is required by law to report any winnings of $600 or more to the IRS. This means that if you win more than $600 in a calendar year on FanDuel, you’ll receive a Form 1099-MISC from the platform, which you’ll need to include in your tax .

Every time bettors lose a $1,100 bet, they lose $1,100. But every time sportsbooks lose a $1,100 bet, they only lose $1,000. So if a bettor makes 10 wagers of $1,100 each and goes 5-5 on those .Welcome to FanDuel Sportsbook, where you can find the best sports betting odds for all of your favorite sports and events. Whether you're looking to place a bet on NFL, NBA, NHL, MLB, college sports, or any other competition, use America's number one legal online sportsbook! We offer the largest selection of betting options, including .

If you win money from the promotional bonuses, however, the winnings will be taxed. Bet $5, Get $300 in Bonus Bets If Your Bet Wins Visit Site Must be 21+ and present in OH. Gambling Problem? Call 1-800-GAMBLER . If you happen to lose money with a brand like FanDuel Ohio, make sure you keep track of things if you plan to deduct.

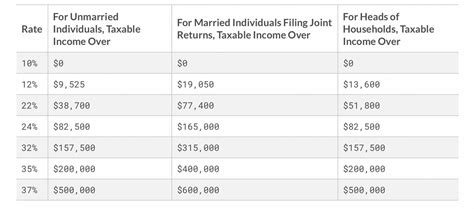

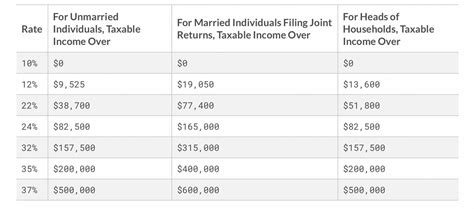

Reporting Taxes Withheld. Most sportsbooks and casinos will begin withholding federal taxes from your winnings on payouts of $5,000 or more. Think of it like your weekly paycheck. If any taxes on your winnings have already been withheld, make sure to report that on the 1099 or W2-G. If you never got one, contact your sportsbook or .Some terrible advice here. If you won the money (even if you didn’t withdraw), legally you should be showing your net winnings on your tax return somewhere. I don’t know what amounts trigger forms to you and the IRS from FD/DK but legally you owe the tax. Look up the concept of “constructive receipt”. 2. Reply.© Betfair Interactive US LLC, 2024 If you or someone you know has a gambling problem or wants help, please check out our Responsible Gaming resources. There are seven tax brackets as of 2024. You would have to have an individual income above $100,525, including your winnings, to move into the 24% tax bracket. That increases to $201,050 for .

706 talking about this. We aim to promote excellence by delivering innovative HR programs and strategies to build competent,.In this year, Higher Secondary School Certificate (HSC) Examination Result 2024 has been published on 26th November 2024. On 26th November 2024, Thursday at 10:00 AM the results will be declared .

fanduel winnings taxed|How to Pay Taxes on Gambling Winnings and Losses